Note From the Desk – Market Update 4/14/25

The last 30 days have been the most challenging time in the markets since March 2020. March 2025 was the first month we lost money since March 2023 and April has started off equally as weak. So, what have we done about it?

7 trading days ago on April 2nd Liberation Day, the Trump administration did what no one expected. What was initially supposed to be “reciprocal tariffs” ended up being wildly disproportional tariffs calculated based on trade deficits. This took the market 100% by surprise and began the next leg of the sell-off. We were equally surprised and accelerated our risk reduction given we were firmly in uncharted territory. Spreads and bid ask dramatically widened and liquidity dried up as we continued to de-risk into the end of last week.

We have been materially reducing risk (decreased longs, increased shorts and took down leverage) in the portfolio since the beginning of March as the headlines and realities of the Tariff policies have upended all fundamentals and technicals in the markets. We are clearly in a Bear market but the difference here is it’s driven by policy, so making money on the short side is very possible but challenging as this market could change in a moment’s notice with as little as a Twitter/X post. Liquidity is extremely poor and relationships between credits have broken down. Highly levered accounts like multi strats have stopped out many managers, putting even more pressure on liquidity and causing exacerbated moves to the downside. The extreme volatility in interest rates and the US dollar has also been challenging and have contributed to a material move wider in credit spreads and flatter in credit curves.

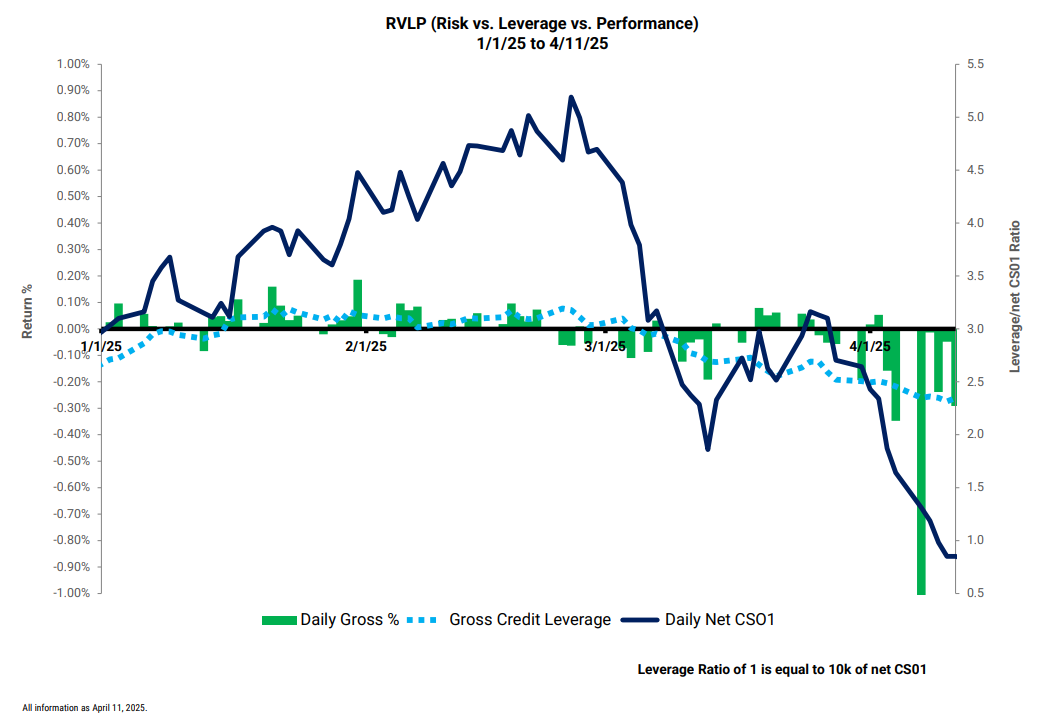

Our portfolio, which was constructed conservatively with a BBB- average credit rating and a short duration of 3 years, is even smaller now with shorter duration. However, uncharacteristically the front end of the curve credit has widened as much as the longer end, meaning the credit curve has flattened, implying massive Risk-off sentiment across the board. We have seen this in all asset classes including oil. Specifically, in the month of March we reduced credit exposure (CS01) by roughly 50% and then proceeded to decisively cut an additional 60% in just the first 2 weeks of April. Overall we are 80% smaller vs. the beginning of March, which has certainly cost us some return, but unequivocally right-sizes our portfolio. In this volatile and unpredictable environment, we take COMFORT in diligently following our Risk and Investment Process. As you can see from the chart below, we practice what we preach – during periods of underperformance we reduce gross notional, reduce credit exposure, and do not double/triple down or introduce basis risk in the form of large derivatives hedge overlays.

Looking forward, there is most definitely light at the end of tunnel, but patience is KEY. We are still waiting on a tax reconciliation bill and deregulation, both of which would be major positives. More importantly regarding tariffs, we are now on a 90-day clock during which we should see multiple countries come to the negotiation table, giving the White House the “wins” it is looking for. This should also begin to help diffuse the standoff with China and set the stage for de-escalation, putting us right around the time the market expects a 25 bps June Fed rate cut (we agree). So, in other words, we will remain smaller and hedged with one of our smallest risk positions since inception and stay nimble for the next 75-90 days while the market and economy digest the aforementioned. Things can turn on a dime so we will diligently look for the Pivot.

Clearly, as I wrote in our monthly letter, we should have been faster in getting smaller, but I can tell you that we are working hard to ascertain where the most profitable opportunities will be once the chaotic policy volatility is finally settled. Getting smaller and preserving our capital puts us in a position to capitalize on lower prices and wider spreads in the near future. We remain very much down in duration, high in quality, with plenty of capacity to deploy into our preferred sectors and companies once the market can get visibility on the administration’s policy, forward earnings, and Fed rate policy – which will likely come together in early summer.

Please let us know if you would like to discuss further and we would be happy to take you through what we have done in more detail and why.

Kind Regards,

Sal Naro